The Banking, Financial Services, and Insurance (BFSI) sector has a legacy that spans over a century, making it one of the most enduring and trusted pillars of the global economy. With deep roots in managing customer relationships and financial stability, the sector has built its reputation on reliability and trust. Today, due to rapid digitization demands, BFSI industry is under constant pressure to upgrade and exist in this market. This is where low-code solutions in BFSI have gained high adaptability and shown significant improvements.

Think of a multinational bank struggling to keep up with growing customer expectations and competition from multiple fronts. The bank needs to quickly launch a personalized loan application portal and integrate it with existing systems, but traditional development cycles are too slow and resource intensive. This is where low-code platforms prove useful as they enable rapid application development and resolve a lot of issues that traditional coding may generally take months to address.

Low-code platforms have played a critical role for digital transformation in BFSI. It is a transformative approach that empowers organizations to modernize at pace, develop applications flexibly, and accelerate digital transformation without requiring extensive technical expertise.

Why Digital Transformation in BFSI is Crucial

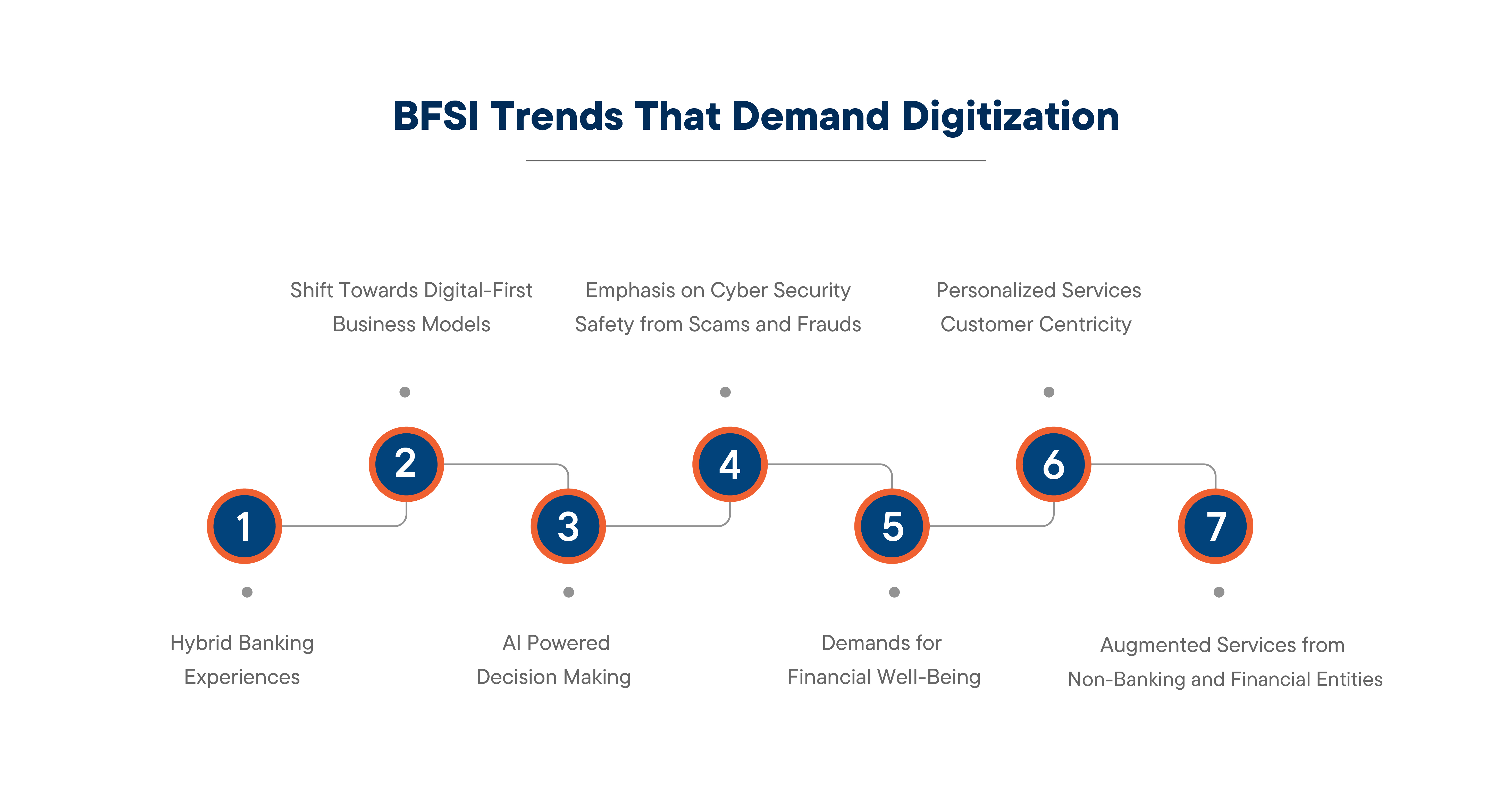

The BFSI sector’s reliance on legacy systems, while foundational in the past, now creates significant challenges in meeting evolving market demands. Embracing digital transformation is not just an option but a necessity for the following reasons:

The BFSI sector’s reliance on legacy systems, while foundational in the past, now creates significant challenges in meeting evolving market demands. Embracing digital transformation is not just an option but a necessity for the following reasons:

Customer Expectations Have Shifted

Today’s customers demand seamless, personalized, and real-time experiences across digital platforms. From instant payments to AI-driven financial consultation, staying competitive means delivering services that match these worthy expectations.

Increasing Regulatory Pressures

Governments and financial regulators worldwide are enforcing stricter compliance requirements to ensure transparency and security. Digital transformation enables institutions to automate compliance processes, reducing risks and ensuring adherence to evolving security standards.

Growing Competition from FinTech’s

Innovative fintech companies are disrupting traditional business models with agile, customer-centric solutions. To retain market share, BFSI organizations must adopt digital technologies to enhance their agility and innovation.

Benefits of Low-Code Applications in Banking and Finance

Low-code platforms are reshaping the BFSI sector, enabling institutions to overcome diverse challenges posed by dated legacy systems. These platforms provide flexibility, speed, and scalability, empowering organizations to thrive in a digital-first environment. Let’s explore the top benefits and the possibilities they unlock.

Unified Customer Experience

Low-code platforms empower banks to deliver uninterrupted, personalized, and real-time services by integrating customer touchpoints. These digital solutions lead to tailored customer journeys, intuitive insights, and high-performing applications. Top low-code platforms for banks can also be used to simplify workflows, boosting customer satisfaction and loyalty through improved customer engagement.

Rules Engine for Loans Decision Making

Low-code solutions for banks can automate certain tasks and remove lengthy decision-making processes. Using a sophisticated rules engine for loan decision-making can make the loan disbursal process quicker and improve customer satisfaction. This dynamic tool can also be designed to follow compliance guidelines, risk assessment, and approvals, crucial for digital transformation in BFSI.

Accelerated Digital Transformation

Low-code platforms drastically reduce the time required to develop and deploy applications. With their visually appealing, intuitive drag-and-drop interfaces and pre-configured modules, BFSI organizations can build reliable and optimized applications in weeks instead of months. Banks and other financial institutions have developed digital wallets, net banking tools, and leveraged the benefits of workflow automation to digitize their operations and this is just the tip of the iceberg.

Personalized Service

Low-code platforms in BFSI are preferred so highly because they rapidly deliver highly personalized and seamless digital experiences tailored to their customers’ needs. These platforms enable the rapid development of mobile banking apps with AI-driven personal finance recommendations, integration of chatbots for instant customer support to reduce call center dependency, and built-in tools for real-time portfolio monitoring and financial goal setting. By leveraging low-code platforms, BFSI organizations can accelerate innovation, enhance customer engagement, and stay competitive in a rapidly evolving digital landscape.

Secure Transactions and Record Management

Security is a cornerstone because of which the demand for low-code in the BFSI sector is so high. Features like built-in encryption, secure access controls, and compliance-ready frameworks ensure multi-level security. By leveraging these platforms, BFSI institutions can protect sensitive data, reduce fraud/cyber security risks, and efficiently align with global security regulatory standards. Safe and Secure records management, a key compliance requirement from global regulators, is critical to avoiding penalties. With low-code, the BFSI sector can address compliance issues effectively and update their operative processes easily whenever new regulations are introduced.

Driving BFSI Transformation through Low-Code

In an ever-evolving sector like BFSI, it becomes crucial for business institutions to stay ahead of competition and continuously innovate themselves. With low-code in BFSI banks and other financial institutions can make their processes more agile, streamline operations, improve customer satisfaction, manage risks better, and innovate products continuously. Low-code applications offer the speed, scalability, and cost-efficiency necessary to thrive in this digital era. As a trusted leader in low-code solutions, iLeap empowers BFSI institutions to unlock their true untapped potential. Ready to transform your operations? Start your journey with iLeap today!

https://ileap.io/free-trial/