Imagine a typical Monday morning at a bustling health insurance office. Sarah, a claims officer, begins her day by sifting through a mountain of claim documents. She spots inconsistencies in hand-written notes, struggles with diverse document formats, and grapples with poorly scanned images. Every minor error could lead to significant financial losses or, worse, a delay in a patient receiving critical care. This scenario is not just frustrating for Sarah; it is a snapshot of an industry-wide issue affecting customer satisfaction at a fundamental level.

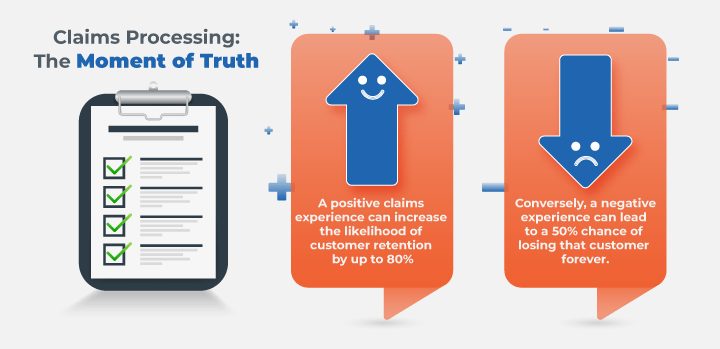

The stakes are high in the insurance sector, where the claim process is often considered the ‘moment of truth’ for customer loyalty. Research shows that a positive claims experience can increase the likelihood of customer retention by up to 80%. Conversely, a negative experience can lead to a 50% chance of losing that customer forever.

However, despite advancements, many insurers like Sarah’s employer still rely heavily on manual processes to handle claims documentation. This not only increases the risk of errors and delays but also burdens staff who could otherwise focus on more critical, decision-centric tasks.

The Growing Complexity of Claims Documentation

In an industry where precision and speed are paramount, the challenges of managing complex and unstructured data cannot be understated. Insurance claims documentation comes in various formats and often includes unstructured data that traditional OCR (Optical Character Recognition) technology struggles to decipher reliably.

Moreover, the presence of ‘noise’—irrelevant or extraneous information—further complicates data extraction, making the process cumbersome and error-prone. Such inefficiencies can lead to significant operational bottlenecks, directly impacting the overall efficiency and customer experience.

Why the Urgency?

The answer is simple: customer expectations are evolving. Today’s customers are accustomed to swift, seamless service in almost every other aspect of their lives. A study by McKinsey noted that the responsiveness in claims processing is a critical factor in customer satisfaction.

Furthermore, the industry is observing a sharp increase in the volume of claims, partly due to the ongoing global health scenarios. Insurers are at a tipping point were sticking to traditional methods may no longer be sustainable.

Choosing the Right Partner: A Strategic Imperative

In this landscape, choosing the right technology partner is not just about adopting advanced solutions but ensuring these solutions align with specific business needs. This is where iLeap stands out. As an enterprise low-code application development platform, iLeap offers AI-powered Intelligent Document Processing (IDP) connectors that dramatically reduce the implementation time from months to weeks or even days.

Integration of iLeap and IDP:

The integration of iLeap enterprise low code platform with IDP allows for the automation of document processing, enabling claims officers and adjudicators to handle claims more efficiently and with fewer errors.

For CIOs and transformation officers, the minimal coding requirement means less technical debt and easier maintenance over time.

Implementation and Beyond

The journey does not end at implementation. The real test is in the longevity and adaptability of the solution. A partner like iLeap not only simplifies the initial setup but ensures that the system evolves with your business, accommodating new types of documents and data extraction needs without significant overhauls.

Conclusion: A Call to Action

For CEOs, CIOs, and transformation leaders in the insurance industry, the message is clear: the time to act is now. By embracing AI-driven solutions like those offered by iLeap, insurers can enhance their claims processing capabilities, improve customer satisfaction, and stay competitive in a rapidly evolving market.

Remember, in today’s digital age, the right technological adoption could be the difference between leading the market or lagging behind. Choose wisely, act swiftly, and transform the ‘moment of truth’ into a moment of triumph for your customers and your team.

- Claims processing in the insurance sector is burdened by manual tasks, leading to errors and delays.

- The complexity of claims documentation, including diverse formats and unstructured data, poses significant challenges.

Evolving customer expectations and increasing claim volumes necessitate a shift from traditional methods. - Choosing the right technology partner, such as iLeap, is crucial for streamlining claims processing.

- iLeap offers AI-powered Intelligent Document Processing (IDP) connectors to automate document processing and reduce implementation time.

- Implementation of AI-driven solutions along with iLeap low-code platform can enhance claims processing capabilities, improve customer satisfaction, and ensure competitiveness in the insurance market.