Claims processing in the insurance sector faces a myriad of challenges. Perennial Issues like inefficiencies, manual errors and stringent regulatory complexities keep this sector on edge. Apart from that, meeting the growing customer demand for speed, accuracy, and transparency in claims management requires the need for digitalization urgently.

For an insurer that has been operating for decades and serves millions of customers, delayed claims processing and rising customer expectations can pose significant challenges. For such entities, it becomes essential to digitize and adopt applications that address these needs effectively. Low-code applications in insurance offer a game-changing solution by enabling faster, streamlined workflows. They significantly enhance operational efficiency and improve customer satisfaction. Unlike traditional application development, which can take months, low-code applications are built and deployed in a fraction of the time relatively.

By leveraging claims processing automation, insurers can minimize manual intervention, improve accuracy, and ensure regulatory compliance. These low-code automation platforms empower organizations to deliver real-time resolutions, reduce operational costs, and focus resources on innovation. As the industry evolves, low-code solutions are proving indispensable for staying competitive and future-ready.

Why Streamlining Claims Processing is Crucial

Efficient claims processing is the backbone of the insurance sector. As other industries have rapidly digitized over the last decade to meet evolving demands, the insurance industry faces an urgent need to modernize its processes. Let’s explore some key reasons which make streamlining claims processing more crucial than ever.

Rising Customer Expectations: Customers today demand faster claim resolutions and greater transparency throughout the process. Insurance process optimization powered by digital solutions ensures seamless experiences, enhancing satisfaction and trust in an increasingly competitive market.

Regulatory Pressures: Adhering to evolving regulations is critical to maintaining compliance and avoiding penalties. Claims processing automation simplifies compliance tracking, reduces manual errors, and ensures regulatory standards are met efficiently and securely.

Underwriting and Claims Cycles: Lengthy underwriting and claims cycles are a major competitive disadvantage, driving customers toward agile competitors. Insurance claims management software automates these processes, reducing turnaround times and improving efficiency to meet evolving customer demands.

Competition from InsurTechs: InsurTech startups are offering faster, more efficient claims experiences. Their innovative, customer-centric approaches put pressure on traditional insurers to modernize and stay competitive.

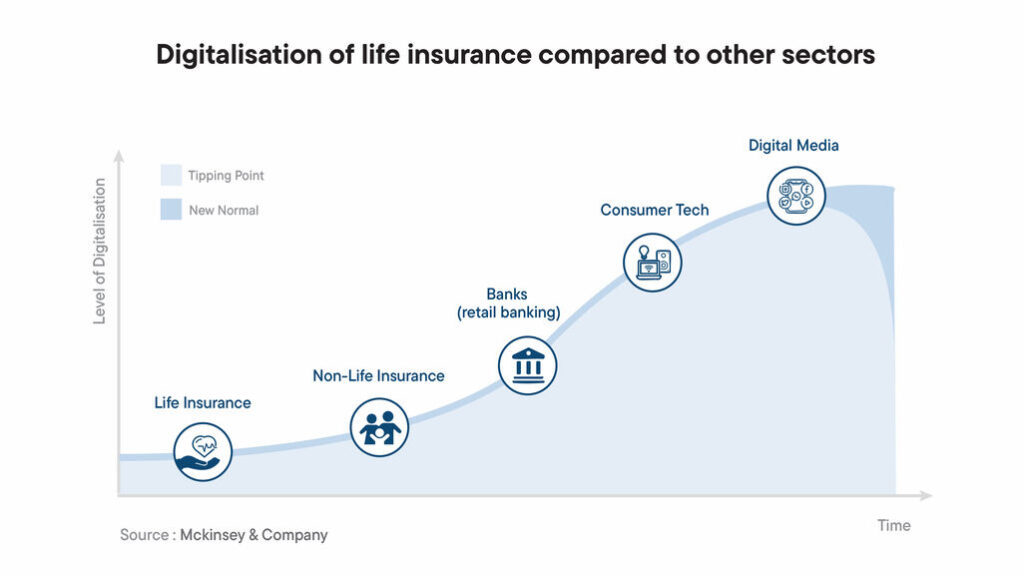

Compared to other industries, life insurance is still in the early stages when it comes to digitization.

Top Benefits of Low-Code Applications in Claims Processing

Low-code platforms bring significant benefits to claims processing by enabling faster development and process automation. These solutions simplify several processes, making them indispensable for modern insurers. Low-code applications offer several significant benefits, some of the primary ones being:

Real-Time Insights for Decision-Making

Low-code applications in insurance enable real-time data analytics, allowing insurers to monitor claims trends, identify bottlenecks, assess risks, and make swift, informed decisions. For instance, real-time dashboards powered by predictive analytics help identify fraud patterns early, ensuring proactive responses and improved operational efficiency. Additionally, claims managers can make data-driven decisions to optimize operations as well.

Consolidate Project Management

Certain new-age low-code platforms come with built-in project management features. It offers a unified workspace for both development and management. These tools streamline processes by combining task tracking, real-time collaboration, automated workflows, and more in a single environment. This ensures seamless communication among team members, reduces the need for multiple tools, and enhances efficiency across various processes making claims processing easier and faster.

Automated Claims Handling

Automation reduces human errors and accelerates claims resolution. Low code solutions automate various key aspects of claims process, such as quotation generation, approval workflows, and payment submissions. By simplifying these key processes, insurers can handle claims more swiftly and accurately. In addition, automation ensures faster and more accurate outcomes, significantly minimizing the risk of fraud for insurers. Claims processing automation simplifies repetitive tasks, saving time and resources. The benefits of low-code platforms include streamlined workflows, operational efficiency, and improved customer satisfaction.

Personalized Customer Experiences

Insurers can enhance communication with chatbot integration for real-time claims updates. Mobile apps ensure seamless interaction with customers anytime, anywhere. These solutions drive insurance process optimization, improving engagement and building trust through tailored, customer-centric services.

Using Low code solutions, Insurers can offer personalized and user-friendly experiences, such as mobile claims submission and real-time status updates, leading to higher customer satisfaction and loyalty.

Improved Fraud Detection and Compliance

Low-code platforms offer robust built-in security features that safeguard sensitive claim data. These tools simplify adherence to evolving regulations, reducing compliance risks. Claims processing automation further enhances fraud detection by identifying suspicious patterns and streamlining investigative workflows. Low-code solutions often come with integrated AI and machine learning capabilities, which can be leveraged to detect anomalies and flag potentially fraudulent claims, reducing losses and ensuring the integrity of the claims process.

In addition, low-code solutions facilitate the creation of compliance monitoring systems that can be tailored to meet regulatory requirements. Insurers can quickly adapt their processes to comply with new regulations while maintaining oversight of compliance metrics.

Reduce Tech Debt

With low-code platforms, insurers don’t need to invest a lot in new technologies. This approach minimizes tech debt, ensuring long-term sustainability and simplifying the management of legacy systems while integrating new capabilities.

Most importantly, low-code solutions are easier to maintain and update. They tend to accumulate less technical debt over time compared to traditional custom-coded solutions. This makes it simpler to keep the technology stack current and aligned with the company’s strategic goals.

Scalability with Increased Agility and Flexibility

Low-code solutions are designed to be easily scalable, allowing insurers to handle increasing claim volumes without the need for significant investments in infrastructure or additional development resources. Insurers can adapt more readily to market changes with low-code applications. The ability of low code to create custom workflows without extensive coding allows for rapid adjustments to products and services based on customer demands. This agility is crucial in a competitive landscape where customer expectations are continually evolving.

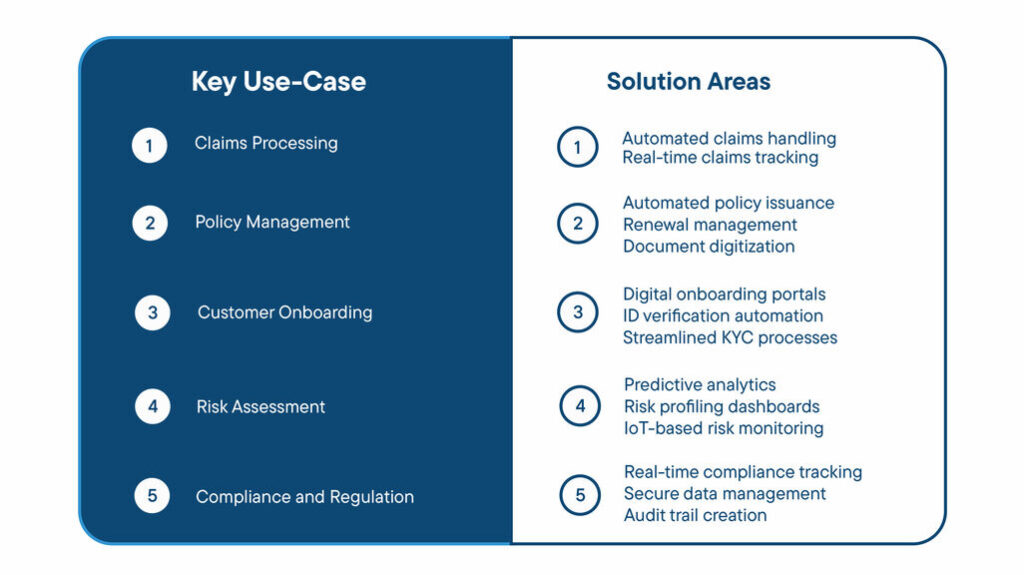

Key Use-Cases You Can Improve Through Low-Code Applications in Insurance Sector

How Low-Code Drives Transformation in Insurance

Low-code technology is best when it comes to simplifying complex processes and accelerating application development. Irrespective of the industry, low-code should be considered for its ability to streamline workflows, enhance efficiency, and reduce operational costs. For the insurance industry, it makes sense to adapt low-code because it offers speed without hindering critical operations like claims management and underwriting.

Low-code applications in insurance foster innovation by enabling insurers to launch customer-centric solutions quickly. They enhance customer satisfaction through seamless digital experiences and create a competitive edge by improving scalability and agility.

With iLeap’s tailored solutions, insurers can harness these time-tested benefits to optimize processes, ensure compliance, and deliver exceptional customer value in a rapidly evolving market.